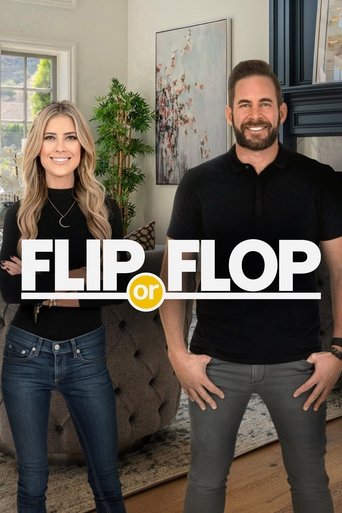

Flip or Flop Season 2

Tarek and Christina El Moussa buy distressed properties -- foreclosures, short sales and bank-owned homes -- remodel them and sell them at a profit. At least, that's the way it's supposed to work. Track the El Moussas' roller-coaster journey in each episode, beginning with a cash purchase at auction of a home -- often sight unseen -- and the fix-it-up process, to the nail-biting wait to find a buyer.

Watch NowWith 30 Day Free Trial!

Flip or Flop

2013 / TV-G

Tarek and Christina El Moussa buy distressed properties -- foreclosures, short sales and bank-owned homes -- remodel them and sell them at a profit. At least, that's the way it's supposed to work. Track the El Moussas' roller-coaster journey in each episode, beginning with a cash purchase at auction of a home -- often sight unseen -- and the fix-it-up process, to the nail-biting wait to find a buyer.

Watch Trailer

With 30 Day Free Trial!

Flip or Flop Season 2 Full Episode Guide

Tarek and Christina step out of their comfort zone when taking on an architecturally significant mid-century modern home.

Tarek and Christina spot a listing that seems too good to be true, and as is often the case, the house doesn't exactly match the potential it had in the listing. But even with a major surprise in the details about the house, Tarek and Christina still see an opportunity for profit and embark on a fast flip with a new contractor. Will Tarek and Christina's gamble on this home and a new contractor pay off big profits or will this turn out to be nothing.

Tarek and Christina come across a trust sale listing in Buena Park, California that looks very well-priced in comparison to recent sales in the area. After walking the home with their contractor and receiving a preliminary budget estimate, they're excited by the potential for profit. But as work begins and renovation costs rise on changing plans and hidden problems, their enticing profit margin appears to be on a downward spiral. Can Tarek and Christina rehabilitate this home into modern splendor or will mounting costs leave it to remain a ranch house of ruin?

Tarek and Christina come across a short sale listing in a desirable, hilly neighborhood of La Mirada, California. Although its price as compared to recent sales in the area leaves a tighter profit margin than they would like, the 1990s home is newer than the investment properties they typically buy and shouldn't need as much renovation as a result. With Tarek and Christina's usual contractor tied up by their growing roster of flip properties, they turn to a new contractor who comes recommended by fellow flippers. Will this newer home and new contractor make for a straightforward flip or could surprise costs and small mistakes leave Tarek and Christina risking a flop on this hilltop hangup?

Tarek and Christina get a lead on a home in Anaheim, California that is being offered as a quick, all-cash sale with no inspections and no contingencies. This seems like a project that's right up their alley. But with a tenant still living in the property, Tarek and Christina can't see inside the home before deciding to make an offer and anything could be behind that front door. Will the unknown spell disaster or could a little tender loving care be all that's needed to reverse the woes of this neglected flip?

Christina receives an e-mail from an agent who has a listing in the South Bay neighborhood of Hawthorne. The dated house needs a lot of work and while it's situated on a busy street near an airport and a noisy elementary school, its attractive list price draws in Tarek and Christina. It's a challenge, but this total renovation is the kind of project they love to take on. That is until work begins and a multitude of hidden problems rise to the surface. Will Tarek and Christina's high hopes fall on deaf ears, or can they overcome this home's loud, louder, and loudest problems to turn a profit?

Tarek and Christina come across an intriguing short sale listing in the desirable neighborhood of Torrance. The exterior is in good shape and the comparable properties indicate the house could be a good value; but once they tour the home it becomes immediately clear that a lot of work and a lot of money will be required to update this 1927 home. Convinced that there's a profit to be made here despite the numerous challenges, Tarek and Christina punch their dance card and purchase the property. Can Tarek and Christina navigate this renovation maze or will they live to regret taking this house out for a barnyard dance?

Tarek and Christina get a lead on a short sale listing in Anaheim Hills that has just fallen out of escrow. The large home shows promise and with a heftier-than-usual price tag, Tarek and Christina will need financial help.

Tarek and Christina are contacted by a cash strapped flipper who needs to unload a project house. With no bathrooms, no kitchen and nothing but plywood floors, exposed framing and piles of rubble, Tarek starts adding up the dollars required just to rehab the house.

Tarek and Christina spot a home listing online that's set for an auction that afternoon and based on neighborhood comps, the dirty and dated house looks like a bargain. By outward appearances, all it needs is an inexpensive cosmetic rehab. But after an unusual auction and a bevy of surprise issues, this dirty, dated and undesired home has quickly become more work than Tarek and Christina ever imagined.

Tarek and Christina find a short sale home listed in Whittier, California that's rather small but the asking price of $275,000 looks enticing next to comparable properties in the area. With their own resources spread thinly across other flips, Tarek and Christina have only $300,000 to spend on the home and its renovation. Despite their rigid debt ceiling, they're convinced they can purchase and rehab the home within a strict budget. But as problems are discovered and the margins start getting tighter, Tarek and Christina hope they can turn a profit on this investment home that is too small to fail.

Tarek and Christina come across a bank-owned listing which has been on the market for fewer than 24 hours and is only accepting offers until 5:00pm the very same day. It's a house with great potential and Tarek is ready to pounce, so they make an offer and the bank accepts. But as renovation rolls along to bring this home to its true potential, problems arise. As budgets crash through ceilings and deadlines continue to be pushed, could this latest flip turn out to be nothing but trouble, or will it prove it always had nothing but potential?

Tarek and Christina get a lead on a listing in an upscale neighborhood of Whittier, California and although the entire home will need some serious updating from its original 1969 finishes, the renovation appears to be mostly cosmetic and comparable properties suggest great potential for profit. With all their money tied up in other flips, Tarek and Christina must secure a hard money loan to make an offer on the home; but that alone will cost them hundreds of dollars a day in interest and one never knows what budget-busting financial hazards could be lurking behind those popcorn-textured walls. Can their contractor renovate this big house in a small timeframe or will unforeseen problems leave the project a day late and a dollar short? Could this high-end home and its expensive loan leave Tarek and Christina singing the hard money blues?

Bidding on a distant property without a preview.

Free Trial Channels

Seasons