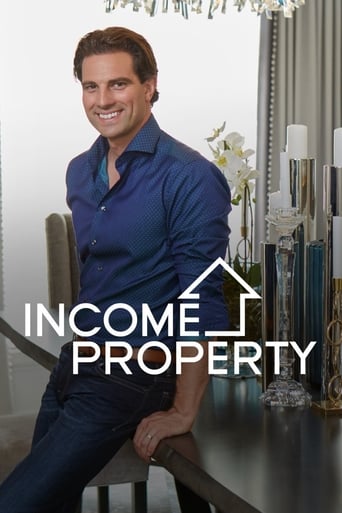

Income Property Season 7

Income Property is a home-improvement show which airs on HGTV. The host, Scott McGillivray, is a home contractor and renovation specialist who helps homeowners make their mortgage payments by adding a rental unit to their house. The series premiered on HGTV on January 1, 2009. New episodes air Tuesdays at 9pm ET on HGTV US and Thursday at 9pm ET on HGTV Canada. The program was a half-hour long until 2013, when it became an hour-long show.

Watch NowWith 30 Day Free Trial!

Income Property

2009 / TV-G

Income Property is a home-improvement show which airs on HGTV. The host, Scott McGillivray, is a home contractor and renovation specialist who helps homeowners make their mortgage payments by adding a rental unit to their house. The series premiered on HGTV on January 1, 2009. New episodes air Tuesdays at 9pm ET on HGTV US and Thursday at 9pm ET on HGTV Canada. The program was a half-hour long until 2013, when it became an hour-long show.

Watch Trailer

With 30 Day Free Trial!

Income Property Season 7 Full Episode Guide

At 34 years old, Sarah and Milo have big dreams of saying sayonara to their jobs by the time they’re 45. Scott shows them the difference between what makes a house a good home, and what makes a house a good investment. It’s a race against time for these two, who know that without Scott’s help, their current rut will remain their permanent routine.

Jason and Peky are an ultra-energetic 21st century couple. They’re married, expecting a child, and are ready to buy their first income property – all at once. As they save money for their growing family, they can’t spare a single penny to start repaying Peky’s monumental student debt. Scott shows them the value in the fixer-upper properties that they can afford, and helps them find the perfect basement apartment to kickstart their lives together.

Marko and Jackie are an urban couple who want to take control of their financial future. Jackie already owns an income property, so Marko is desperate to get into the game.

Mary and Bridge dream of comfortably retiring to the great outdoors, without having to worry about money. They need to find a family home with basement apartment potential to fund their retirement dreams. Scott shows them how to make a wise investment in the country, while maintaining the balance between their dream home and a hot rental property.

Stephanie and Elyse are a cop and paramedic thinking ahead. They have big dreams of securing their financial future together, and have chosen real estate as their investment of choice. Scott shows them how to find a dedicated income property to best invest in their future - STAT.

Mike and Vita are successful professionals, but when it comes to the world of income properties, they’re on brand new turf. They want to purchase a dedicated rental property with long term value. Scott guides this couple on how to find the right house in the right neighbourhood.

Andrew and Chris are life-long buddies each living in the suburbs of the big city. They have big dreams of using a portfolio of shared income properties to retire at age 55. Scott shares his first-hand advice with these rookie investors. He helps build the foundation for the boys’ business, so that it maintains financial success – and most importantly – their friendship.

Kuo Bao and Megan are a twenty-something couple living and loving life in the big city. This ambitious couple is determined to grow a portfolio of investment properties together, in order to support their aging parents throughout retirement. With a lofty goal of supporting themselves and two sets of parents, Scott shows them how to find the right house to achieve their financial goals.

Dan and Tania are a young couple determined to leave their parents’ suburban homes in exchange for the big city. They need to find a home with multiple units, so that they can afford to live where they like to play.

Alison and Deirdre are sisters whose only thing in common is their DNA. They’re best friends, confidantes, and partners in crime, but most of all – nothing alike. Alison wants to buy her very own income property, but Deirdre thinks it’ll be a hassle, and discourages the whole thing. Scott helps Alison approach her purchase as a investor versus emotional homeowner. It’s about practicality and functionality, and of course - some sibling rivalry.

Jeff and Kirsti are newlyweds living the big-city life: paying too-high rent for a small apartment in the sky, and relentlessly working 9 to 5. They want to become the couple that’s ahead of the pack, choosing work based on passion versus financial need. Scott shows this ambitious couple how to balance an investment property with a home - large enough to accommodate their expanding family.

Karen and Kevin are a twenty-something suburban couple totally in love, totally committed – and totally not on the same page. Kevin wants a real estate empire, and Karen wants nothing to do with it. Where Kevin sees opportunity, cash-flow, and excitement, Karen sees hardship, debt, and drama. Scott settles this couple’s differences, by showing them how to make a smart, wise, and most of all safe, investment.

Marli & Toby are serial renters ready to become serious investors. They’ve borrowed a pretty penny from Marli’s parents over the years, and know that it’s time to start repaying the debt. Scott helps them decide between single-family homes with income potential, and an existing duplex.

Free Trial Channels

Seasons