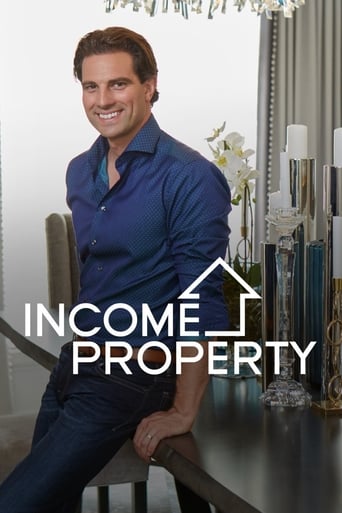

Income Property Season 8

Income Property is a home-improvement show which airs on HGTV. The host, Scott McGillivray, is a home contractor and renovation specialist who helps homeowners make their mortgage payments by adding a rental unit to their house. The series premiered on HGTV on January 1, 2009. New episodes air Tuesdays at 9pm ET on HGTV US and Thursday at 9pm ET on HGTV Canada. The program was a half-hour long until 2013, when it became an hour-long show.

Watch NowWith 30 Day Free Trial!

Income Property

2009 / TV-G

Income Property is a home-improvement show which airs on HGTV. The host, Scott McGillivray, is a home contractor and renovation specialist who helps homeowners make their mortgage payments by adding a rental unit to their house. The series premiered on HGTV on January 1, 2009. New episodes air Tuesdays at 9pm ET on HGTV US and Thursday at 9pm ET on HGTV Canada. The program was a half-hour long until 2013, when it became an hour-long show.

Watch Trailer

With 30 Day Free Trial!

Income Property Season 8 Full Episode Guide

A new couple needs an income suite to manage their substantial mortgage, so they consider two and three bedrooms.

A couple wants to generate more money for their business by splitting their single family rental into a duplex.

Allan & Nasreen need to find a home with income suite to supplement Nasreen’s income as she leaves the workforce and starts her own reiki healing business. This property will be both Allan and Nasreen’s first foray into homeownership, so they’re relying on Scott to help them find and renovate the perfect property, which will play triple duty as their home, a source of income, and a space to grow their business.

Grant and Eve need to find a home with rental suite so that they can fund their annual $10,000 trips to Australia to visit Grant’s family and hometown. They need Scott’s help to make sure that they secure their finances in such a way that they feel safe and confident in their new roles as landlords.

Dave and Lucia are planning a big wedding and they want to buy their first home. They're paying for it all on their own, so they need an income property to make it all work. Scott takes this young ambitious couple to see a classic bungalow, a side-split and a contemporary bungalow.

Sidra has sacrificed and saved. Now she's ready to invest all of it into an income property. With Sidra's father along for the ride, Scott shows them three very different investment strategies in the form of a purpose built duplex, an Edwardian semi-detached, and a renovated bungalow.

After attempting a career change, Joe fell into serious financial trouble. He needs to downsize to a smaller home with an income property so he can pay down his looming debts. Scott shows Joe and his brother a detached two-story home, a semi-detached bungalow, and a split-level duplex.

Nick and Karen are trying to start a family. They want to upsize from their condo, but to afford the house of their dreams, it has to have an income property. While they wait for the stork to arrive, Scott shows them a Victorian Triplex, an American Colonial home, and a Tudor-style home.

Sarah and Jim are blending their families, and together they have five daughters to put through college. They're gearing up for an expensive future with an ambitious investment plan to buy four income properties in five years. Scott helps them decide between a detached back-split, a tenanted semi-detached bungalow, and a single family home.

Erin needs to move out of her cramped condo so that she can have more space and a yard for her dogs. She wants her home and her finances to be princess perfect, so she needs a house with income property potential. Scott and Erin's friend Alana help her choose between two bungalows in the city, and beautiful suburban home.

Jen and Brock dream of buying a home downtown, but it needs to have an income property if they want to afford it. Scott shows them a 100-year-old row house, a single-family home, and an east end duplex; before sky-high housing prices threaten to scare them away from buying altogether.

Ann-Marie and Scott have big dreams of traveling the world, and to help finance their adventures, they need to invest in an income property. Scott helps them choose between a downtown condo, a house with student rental potential, and a 2-unit bungalow.

Bryan and Marissa have been living with Marissa's mom for six years. They've saved up and now they want to buy an income property where they can live for now, and count on as an investment down the road, all with their wedding on the horizon. Scott helps them choose between a downtown duplex, a recently renovated duplex, and a beautiful suburban home.

After suffering the sudden and tragic loss of her husband, Deb decides she wants to help her daughter Sarah and her son-in-law Matt buy a home with an income property to start them on the right foot. Mom will live in the suite until she gets back on her feet, then Matt and Sarah will rent it out down the road. Scott and the trio tour a new build, a bungalow, and a 2-story home with student rental potential.

Michael and Karen need to find an urban house with basement apartment so that they can afford to move into the city and reduce Karen’s 2-hour commute to work. Without Scott’s help, they know that they’ll be stuck in the ‘burbs – or even worse – Karen will miss out on precious family time with their baby boy.

Free Trial Channels

Seasons